Get the free georgia form oic 1 pdffiller com

Show details

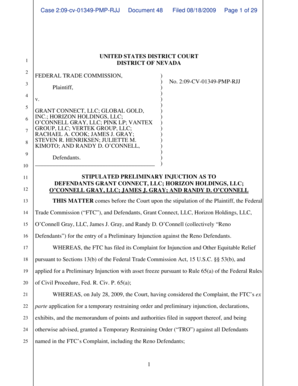

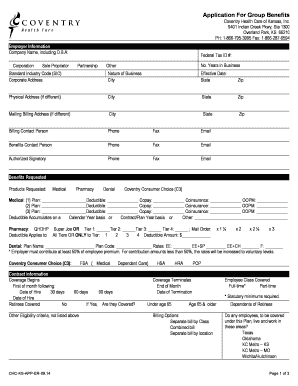

Clear Print Georgia Department of Revenue Income Certification for Offer in Compromise Application Fee Form OIC-1A (March 2011) (For Individual Taxpayers Only) If you are not required to submit the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your georgia form oic 1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your georgia form oic 1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit georgia form oic 1 pdffiller com online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit georgia form oic 1 pdffiller com. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

How to fill out georgia form oic 1

How to fill out Georgia form OIC 1:

01

Begin by downloading or obtaining a copy of the Georgia form OIC 1.

02

Fill in your personal information accurately, including your full name, address, social security number, and contact information.

03

Provide details about the tax period or periods the form relates to, including the specific tax type and the tax years.

04

Indicate the amount of tax you owe and any penalties or interest assessed.

05

Provide an explanation for your inability to pay the full amount owed, along with any supporting documents or evidence.

06

If you are proposing an offer in compromise (OIC), specify the amount you are offering to pay and the basis for your offer.

07

Sign and date the Georgia form OIC 1, and ensure you have reviewed the form for accuracy and completeness.

Who needs Georgia form OIC 1:

01

Individuals who are unable to pay their full tax liabilities to the state of Georgia.

02

Taxpayers who believe they have a legitimate basis for negotiating an offer in compromise (OIC) with the Georgia Department of Revenue.

03

Those who have received notification or assessment of taxes, penalties, or interest from the state of Georgia and are seeking to resolve their tax debt.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Georgia form oic 1?

Georgia form OIC 1 is an Offer in Compromise (OIC) form that allows taxpayers to propose a compromise settlement for their outstanding tax liabilities with the Georgia Department of Revenue.

Who is required to file Georgia form oic 1?

Any individual or business entity in Georgia who wishes to negotiate a settlement for their tax liabilities can file Georgia form OIC 1.

How to fill out Georgia form oic 1?

To fill out Georgia form OIC 1, you need to provide detailed information about your tax liabilities, financial situation, and reasons for requesting a compromise settlement. The form should be completed accurately and submitted with supporting documentation as required.

What is the purpose of Georgia form oic 1?

The purpose of Georgia form OIC 1 is to initiate the process of negotiating a compromise settlement for tax liabilities. It allows taxpayers who are unable to pay their full tax debts to propose an alternative payment amount that is more manageable based on their financial situation.

What information must be reported on Georgia form oic 1?

Georgia form OIC 1 requires taxpayers to report detailed information regarding their tax liabilities, assets, income, expenses, and their proposed compromise settlement terms. It is important to accurately provide all the required information and supporting documentation.

When is the deadline to file Georgia form oic 1 in 2023?

The specific deadline to file Georgia form OIC 1 in 2023 will depend on the instructions provided by the Georgia Department of Revenue. Taxpayers are advised to check the department's website or contact them directly for the most accurate and up-to-date deadline information.

What is the penalty for the late filing of Georgia form oic 1?

The penalty for the late filing of Georgia form OIC 1 can vary depending on the specific circumstances and discretion of the Georgia Department of Revenue. It is advisable to file the form by the given deadline to avoid any potential penalties or complications.

How do I complete georgia form oic 1 pdffiller com online?

pdfFiller makes it easy to finish and sign georgia form oic 1 pdffiller com online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I make edits in georgia form oic 1 pdffiller com without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your georgia form oic 1 pdffiller com, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I edit georgia form oic 1 pdffiller com on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign georgia form oic 1 pdffiller com on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Fill out your georgia form oic 1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.